In fact, he stated that he wants his wife's money invested in such a fund after he's gone. Warren Buffett's favorite investmentīillionaire investor Warren Buffett has said that an S&P 500 index fund is the best investment most Americans can make. Mutual funds are priced daily, and your purchase or sale isn't instantaneous. You can buy or sell an ETF instantly through a brokerage at the then-current price. mutual funds is that ETFs trade like a stock. The main difference between buying S&P 500 ETFs vs. The most widely traded of these ETFs include: Today, several S&P 500 ETFs are available that have very low annual expense ratios (the percentage of the fund's assets that go toward annual fees). For a long time, buying low-cost mutual funds was the best way for investors to track the performance of the S&P 500 index. That was especially the case before online brokerages that didn't charge for stock trades became popular. Investing in each S&P 500 stock individually isn't a very practical approach.

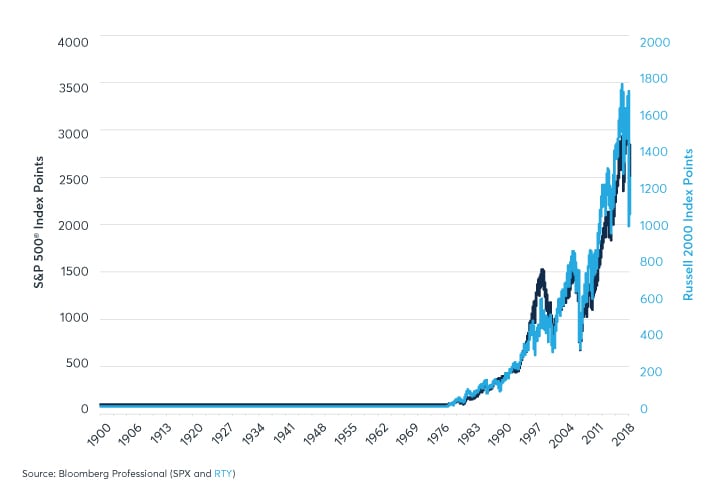

Buy an exchange-traded fund (ETF) that tracks the S&P 500 index.Buy a mutual fund that tracks the S&P 500 index.Buy shares of all 500 individual stocks.There are three ways to invest in the S&P 500 index: ^SPX data by YCharts How can you invest in the S&P 500 index? stock market performance quite well (and does so significantly better than the Dow Jones). And, although it includes far fewer stocks, it tracks the overall U.S. However, the S&P 500 index is more widely known than the Wilshire 5000. It originally included 5,000 stocks but today has around 3,450 stocks. For example, the Wilshire 5000 Total Market Index consists of all stocks traded on major U.S.

There are other indexes that include even more U.S. stock market because of its much greater number of stocks compared to the Dow Jones. The S&P 500 has given a better picture of the overall U.S. stock market, it initially included only 12 stocks and was later expanded to 30 stocks. While the Dow Jones Industrial Average soon became associated with the overall U.S. This index was followed 11 years later by the Dow Jones Average, which was renamed the Dow Jones Industrial Average in 1896. That honor belongs to the Dow Jones Transportation index, which was created in 1884. However, the S&P 500 index wasn't the first stock market index. It was the first stock market index calculated by a computer. In 1957, Standard & Poor's launched the S&P 500 index. Standard Statistics Company merged with Poor Publishing in 1941, forming Standard & Poor's. In 1926, though, the company unveiled a daily index that included 93 stocks.

The origins of the S&P 500 index date back to 1923 when Standard Statistics Company created an index consisting of 233 stocks.

0 kommentar(er)

0 kommentar(er)